India News

GST’s impact on common man

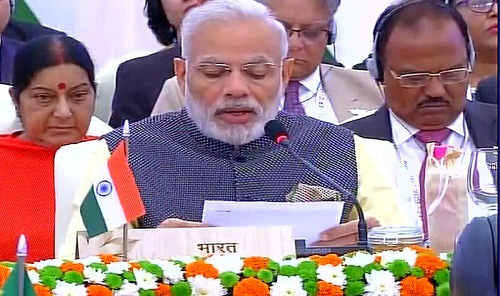

After the Rajya Sabha has passed GST (Goods and Services Tax) bill, Indian government has received appraisals from the nationwide. The impact of this GST is significant to the common man in many ways. Here is a short explanation of it.

The government needs to impose tax to sustain. These taxes will be imposed on the products or services, people buy like food and services in the restaurants, hotels etc. Central taxes, state taxes, excise, VAT, service tax, cess and several such indirect taxes were being levied on the common man all these days, making it a huge burden for him to pay all those. Now all such indirect taxes are going to be replaced with a single tax, called GST.

Till date, each state has their own tax structures, but from now on, the entire country should implement only GST and nothing else. Due to this tax, the products made in the country, would get cheaper, but the service costs may go high.

Here is a short idea of what goes high and what comes down due to GST

Price increase

Cigarrettes, Commerical vehicles, phones, phone bills, clothes, branded jewellery, food in restaurants, AC ticket price in trains.

Price decrease

Two wheelers, car batteries, paints, cement, movie tickets, electronic equipments, fans, air coolers, LED TVs